What is Quant Trading? Effective Quantitative Trading Strategies in Crypto

- rachelbeautybar

- Aug 12

- 3 min read

With rapid advancements in technology, Quant Trading has become increasingly popular in financial markets, especially in crypto trading. Once exclusive to hedge funds and large investment banks, quantitative trading is now accessible to individual investors thanks to AI, big data, and cloud computing.

In this guide, you’ll learn what Quant Trading is, the essential skills you need, and 6 proven strategies to apply in the crypto market.

What is Quant Trading?

Quant Trading (Quantitative Trading) is a trading method that uses mathematical models, statistical analysis, and algorithms to identify trading opportunities and execute buy/sell decisions automatically.

Originally developed for institutional finance, Quant Trading has evolved into a strategy adopted by independent traders – also called Quant Traders – who leverage technology to compete in fast-moving markets.

Essential Skills for a Quant Trader

To become a successful Quant Trader, especially in crypto, you need to master three core areas:

1. Mathematics & Statistics

Probability & Distribution – Understanding probability theory and statistical distributions.

Regression Analysis – Identifying relationships between variables to predict price movements.

Time Series Analysis – Studying market data over time to forecast trends.

2. Programming & Algorithm Development

Proficiency in coding is vital for building and testing automated trading systems. Popular languages include:

Python – Most popular due to flexibility, extensive libraries (Pandas, NumPy, SciPy), and backtesting tools.

R – Strong for statistical modeling and time-series analysis.

C++ – Used for high-frequency trading (HFT) where low latency is critical.

Others: C#, MATLAB, Java.

3. Financial Market Knowledge

Understanding market structure, asset types (stocks, bonds, crypto), and trading mechanics.

Risk management principles: stop-loss, take-profit, and portfolio hedging.

6 Popular Quant Trading Strategies in Crypto

1. Trend Following

Uses mathematical models to identify whether an asset is in an uptrend or downtrend. Common in short-to-medium-term trading.

2. Arbitrage Trading

Exploits price differences between correlated assets or exchanges.

3. High-Frequency Trading (HFT)

Executes thousands to millions of trades within milliseconds to capture small inefficiencies.

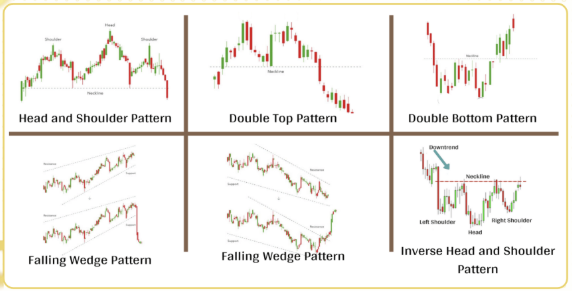

4. Pattern Recognition (Footprint Tracking)

Detects recurring patterns, such as a specific wallet buying BTC daily at 9 AM.

5. Mean Reversion (Reversal Trading)

Buys assets after a sharp drop or sells after a rapid rise, anticipating a return to the average price.

6. Pairs Trading

Identifies two highly correlated assets and trades when their correlation temporarily breaks.

How to Start Quant Trading in Crypto

Collect & Analyze Data – Use APIs to gather price, volume, and sentiment data.

Build a Predictive Model – Apply statistical or machine learning methods to forecast market moves.

Backtest Strategies – Test your model on historical data to evaluate performance.

Deploy on Live Markets – Use automated trading bots to execute strategies.

Monitor & Optimize – Continuously adjust models to adapt to market changes.

Implement Risk Management – Always define stop-loss, position sizing, and diversification rules.

Advantages & Disadvantages of Quant Trading

✅ Advantages

Removes Emotional Bias – Trades are based on data, not feelings.

Automation – Saves time and increases trading speed.

Big Data Processing – Handles massive datasets that humans can’t analyze in real-time.

❌ Disadvantages

Tech Dependency – Requires strong infrastructure and coding expertise.

Model Risk – Poorly optimized models can cause losses.

Market Volatility – Models may fail during extreme events.

Quant Trading vs Algorithmic Trading

While both involve automation:

Quant Trading focuses on building strategies based on statistical and mathematical models.

Algorithmic Trading is broader, including any automated trade execution, not necessarily mathematically driven.

Common Data Used in Quant Trading

Price & Volume Data (OHLCV)

Market Sentiment (social media, news sentiment analysis)

Macroeconomic Indicators (inflation rates, interest rates)

Technical Indicators (RSI, MACD, moving averages)

Tools & Platforms for Quant Trading

QuantLib, Amibroker, Bloomberg Terminal

Python libraries: Pandas, NumPy, TA-Lib

High-performance computers with low-latency exchange connections

Conclusion

Quant Trading empowers traders to make data-driven, emotion-free decisions in the volatile crypto market. By mastering programming, mathematics, and market analysis, you can create profitable, automated strategies that operate 24/7.

Whether you’re aiming for trend following, arbitrage, or high-frequency trading, success comes from rigorous backtesting, risk control, and continuous strategy improvement.

👉 Register via the links below to get up to 70% fee cashback:

Comments