What Is RSI? How to Use the RSI Indicator Effectively in Crypto Trading

- rachelbeautybar

- Aug 5

- 3 min read

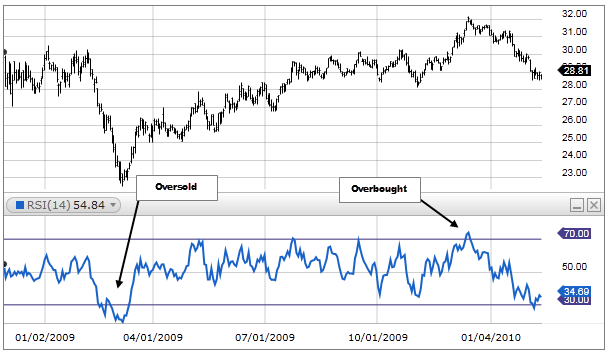

RSI (Relative Strength Index) is a momentum indicator that measures the speed and magnitude of price movements. It ranges from 0 to 100 and helps identify when a crypto asset is:

Overbought → Potential price reversal to the downside

Oversold → Potential price reversal to the upside

✅ Default RSI setting is 14 periods (can be adjusted for sensitivity)

RSI Formula:

RSI = 100 - 100 / (1 + RS)

Where: RS = Average of up closes / Average of down closes

How to Read RSI Levels

RSI > 70 → Overbought (potential reversal or pullback)

RSI < 30 → Oversold (potential rebound or trend reversal)

📊 Some traders adjust RSI thresholds:

For more conservative signals: Use 80/20

For short-term scalping: Use 60/40

Stochastic RSI (StochRSI) – Bonus Insight

StochRSI is the RSI of the RSI—a second derivative that measures RSI’s momentum.

Formula:

Stoch RSI = (RSI - Lowest RSI) / (Highest RSI - Lowest RSI)→ Then multiplied by 100 (to normalize between 0 and 100)

⚠️ StochRSI reacts faster but can give more false signals. It's great for scalping or spotting early entries.

How to Add RSI to Your Chart

Open your crypto chart (e.g., TradingView)

Click Indicators

Search “RSI” or “StochRSI”

Adjust the period (default is 14) as needed

Change overbought/oversold thresholds if desired

Key RSI Trading Signals

1. Overbought Conditions

RSI above 70 signals price may be overbought

Possible trend exhaustion or short-term correction ahead

Consider taking profits or setting tighter stop-losses

Example: Check for RSI > 70 + resistance zone = consider for sell

2. Oversold Conditions

RSI below 30 suggests market is oversold

Potential for reversal or bounce

Can be used to spot accumulation zones

📉 Tip: Check for RSI < 30 + support zone = better entry.

3. Divergence Signals

Divergence occurs when price and RSI move in opposite directions.

✅ Regular Bullish Divergence

Price makes lower low

RSI makes higher low→ Suggests weakening selling pressure → Potential reversal upward

❌ Regular Bearish Divergence

Price makes higher high

RSI makes lower high→ Suggests weakening momentum → Potential reversal downward

🔒 Hidden Divergence (Trend Continuation)

Hidden Bullish: Price makes higher low, RSI makes lower low → Uptrend continuation

Hidden Bearish: Price makes lower high, RSI makes higher high → Downtrend continuation

🧠 Combine divergence with support/resistance or MACD for confirmation.

RSI Trading Strategies

1. Trend Confirmation Using RSI Zones

RSI > 60 and rising → Confirm uptrend

RSI < 40 and falling → Confirm downtrend

RSI between 40–60 → Sideways / consolidation

📈 Entry in the direction of the trend gives higher probability setups.

2. Entry Based on Overbought/Oversold

Buy Setup:

RSI dips below 30, then climbs back above 30

Combine with price action support zone

Sell Setup:

RSI climbs above 70, then drops below 70

Combine with resistance level

⚠️ Don’t buy/sell just because RSI hits 30/70. Wait for confirmation.

3. Multi-Timeframe RSI Strategy

Use higher timeframe (D1) to define trend

Trade lower timeframe (H4) signals in the same direction

Example:

D1 RSI > 50 → look for Buy entries on H4 RSI dips below 30

D1 RSI < 50 → look for Sell entries on H4 RSI spikes above 70

🔁 Helps filter out noise and avoid false signals.

Common Mistakes When Using RSI

❌ Mistake 1: Blindly Acting on RSI 70/30

RSI > 70 doesn't mean price must fall

During bull runs, RSI can stay >70 for weeks

Fix: Combine RSI with volume, candlestick patterns, or moving averages

❌ Mistake 2: Ignoring Market Context

In a strong uptrend, RSI staying high is normal

Waiting for RSI to drop may cause missed opportunities

For long-term investors: Buying at RSI 70 in an uptrend may still be more profitable than waiting for a perfect entry

❌ Mistake 3: Not Using Divergence

Most traders don’t spot divergence early enough

RSI divergence often precedes trend reversals

Solution: Regularly mark RSI highs/lows and compare with price swings

Conclusion

The RSI Indicator is a versatile and beginner-friendly tool in crypto trading. It helps you:

Identify overbought or oversold zones

Confirm market trends

Spot potential reversals using divergence

Time entries and exits with greater confidence

However, RSI alone is not enough. Combine it with MACD, MA, or price action to build a more robust trading strategy.

Whether you’re swing trading or holding spot, understanding RSI can dramatically improve your decision-making and reduce emotional trading.

👉 Register via the links below to get up to 70% fee cashback:

Comments